The Biggest Tax Benefit for Pastors

- Nate Skelly

- Jul 11, 2023

- 4 min read

Updated: Aug 3, 2023

You know what they say about things that sound too good to be... they usually are! But let me assure you, if you're a licensed, ordained, or commissioned minister, this article is worth 10 minutes of your time!

The bottom line is this: if you are a pastor and you are not contributing to a church-sponsored 403(b) you are likely missing out on thousands in tax savings over the coming years.

Understanding the Church-Sponsored 403(b) Plan:

A 403(b) plan is similar to a 401(k), but it is only available for nonprofits. One key advantage of a 403(b) plan is that it doesn't require the same discrimination testing as a 401(k), providing more flexibility for employers. Additionally, 403(b) plans tend to be a lot easier to set up and manage on an on-going basis.

Image source: Mint/Intuit

The Housing Allowance Advantage:

Licensed, ordained, or commissioned ministers can designate a portion of their income as a housing allowance. This allowance, up to certain limits, is not subject to federal income tax.

For example, if a pastor earns $60,000 per year and his church designates $20,000 as housing allowance, only the remaining $40,000 is subject to income tax. Not only does it lower the pastor’s overall tax bill, it also makes him more likely to qualify for certain income-based benefits.

By the way, if you are not already utilizing your housing allowance or unsure if you are able to, speak to your church and your tax professional right away!

But it gets better...

Housing Allowance in Retirement:

Most pastors don't know that housing allowance can extend beyond their employment years. Even in retirement, pastors can still claim housing allowance on withdrawals from their church-sponsored retirement accounts. This is a huge benefit!

For example, let's say a pastor’s housing allowance retires and his church designates his housing allowance amount at $24,000/yr. This means that for his first year of retirement, he would be able to claim up to $24,000 of withdrawals from his church-sponsored 403(b) account as housing allowance and pay no income taxes (or Social Security and Medicare taxes) on those withdrawals. Even though he is no longer being paid by the church, he is withdrawing funds that were set aside in a church-sponsored retirement plan so he is still able to claim housing allowance on those funds.

Keep in mind that any withdrawals above the housing allowance amount would be subject to ordinary income taxes.

Making the Most of the Tax Benefits:

It's important to note that the tax benefits only apply to church-sponsored retirement accounts. If pastors have funds in IRAs or 401(k)s from previous secular jobs, a pastor is not able to claim housing allowance on those withdrawals. However, if a pastor made contributions to an IRA with money earned from his religious duties, he can transfer those IRA funds into a church-sponsored 403(b) account and gain the ability to claim housing allowance on those funds during retirement!

Triple Tax Advantage:

By utilizing the housing allowance provision and contributing to a church-sponsored 403(b) plan, pastors can potentially achieve triple tax advantage: 1. contributions are income tax deductible 2. the growth of the funds inside the 403(b) is tax-deferred 3. withdrawals can be tax-free if designated as housing allowance within the allowed limits. So it is possible for a pastor to not pay any income taxes on his retirement savings at all!

This makes the church-sponsored 403(b) an even better vehicle than a regular IRA or even a Roth IRA.

Additional Tax Benefits:

Contributions made by pastors to their 403(b) accounts also come with another perk. They are exempt from paying Social Security and Medicare taxes on those contributions. Considering that pastors are classified as self-employed and responsible for both the employer and employee portions of these taxes, this exemption can lead to significant savings.

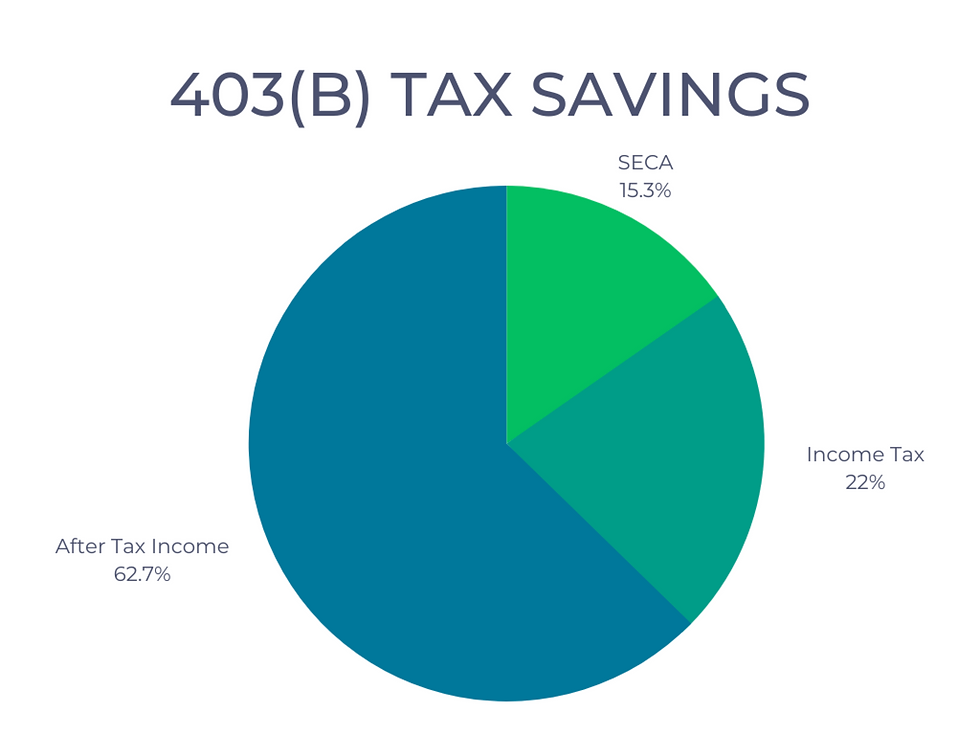

Hypothetical example: a pastor is in the 22% income tax bracket and pays 15.3% Social Security/Medicare tax on his income.

If he contributes $5,000 to his 403(b) account he is saving 37.3% ($1,865) in taxes!

hypothetical example based on a pastor in the 22% income tax bracket

Contribution Limits:

The contribution limits for church-sponsored 403(b) plans are higher than those for traditional IRAs or Roth IRAs. As of 2023, pastors can contribute up to $22,500 per year from their paychecks, and those aged 50 or older can contribute up to $30,000. Additionally, churches have the option to contribute into the pastors account as well. For 2023, the combined limit of employee and employer contributions is $66,000/yr!

Quick note: while most pastors and churches will not come anywhere close to the yearly contribution limit it can be very useful in certain situations.

For instance, let’s say a pastor is getting ready to retire soon. He may want to increase his 403(b) contributions to “front load” his retirement and build up more tax free income for later on.

Or perhaps a church wants to give a substantial gift to a pastor in honor of an anniversary or maybe wants to give a lump sum ahead of retirement. Instead of cutting a check directly to the pastor (which would then be immediately taxable), the church may choose to contribute to his 403(b) plan instead and help the pastor save substantially on taxes.

Conclusion:

The special tax provision for pastors through church-sponsored 403(b) plans offers unparalleled benefits. By maximizing the housing allowance provision and taking advantage of the triple tax advantage, pastors can save a significant amount on taxes and enjoy tax-free withdrawals in retirement.

If you have questions about setting up a 403(b) plan for your church, I’d love to talk with you.

Schedule a quick phone call with Nate here.

Important reminder: always consult with your tax professional when considering any of these steps. This is not tax advice, but rather areas of potential tax savings that you should be aware of.

Comments